Who Acts Smarter in SIP Investments: The Active or the Passive Investor?”

Introduction:

Systematic Investment Plans (SIPs) have gained immense popularity among investors seeking a disciplined approach to wealth creation. SIPs offer a convenient and hassle-free way to invest in mutual funds, allowing individuals to grow their wealth steadily over time.Who Acts Smarter in SIP Investments However, a common question that arises is whether to adopt an active or passive approach to SIP investments. In this blog, we will explore the differences between active and passive SIP investors and help you decide which strategy might be smarter for you.

If you have a specific context or calculation in mind related to “% by year SIP,” please provide more details, and I’d be happy to provide more specific information or calculations based on your needs.

FIRSTLY OPEN DEMAT ACCOUNT FOR INVESTMENT IN SIP

Here’s how you can calculate the future value of your monthly investment:

Future Value = Monthly Investment × [((1 + Monthly Interest Rate)^(Number of Months) – 1) / Monthly Interest Rate]

- Monthly Investment: The amount you invest each month.

- Monthly Interest Rate: The monthly interest rate or expected rate of return on your investment, expressed as a decimal. For example, if you have an annual interest rate of 6%, the monthly interest rate would be 6% / 12 months = 0.5% or 0.005 as a decimal.

- Number of Months: The total number of months you plan to invest.

This formula will help you estimate the future value of your monthly investments over time. Keep in mind that real-world investments may have fees, taxes, and fluctuations in returns that can affect your actual results. It’s essential to consult with a financial advisor and consider the specifics of your investment to make accurate projections.

- Annual SIP Percentage Increase: This could refer to the percentage increase in your SIP contributions each year. For example, if you’re increasing your monthly SIP amount by a certain percentage (e.g., 10%) every year, it would be a way to boost your savings over time.

- Annual Returns on SIP: This could represent the average annual returns on your SIP investments. This percentage would indicate how well your SIP investments have performed on an annual basis.

- Yearly SIP Investment: It might refer to the total amount invested in a SIP in a given year. Who Acts Smarter in SIP Investments For example, if you’re tracking how much you contribute to your SIP each year, this percentage could help you analyze your investment pattern.

- SIP Growth Rate: It could also be related to the growth rate of your SIP investments over the years. This percentage would represent the increase in the value of your investments year by year.

Who Acts Smarter in SIP Investments:

Active SIP investors are individuals who actively manage their investment portfolio.Who Acts Smarter in SIP Investments They frequently monitor their investments, make strategic decisions, and adjust their SIP contributions based on market conditions and their financial goals. Here’s why some investors prefer an active approach:

- Market Timing: Active investors aim to capitalize on market fluctuations by adjusting their SIP contributions during market ups and downs. This approach can potentially yield higher returns if executed correctly.

- Research and Analysis: Active investors enjoy researching and analyzing various mutual funds and financial instruments. Who Acts Smarter in SIP InvestmentsThey make informed decisions based on market trends, fund performance, and economic indicators.

- Flexibility: Active investors have the flexibility to switch between different mutual funds or adjust their investment strategy as their goals and risk tolerance change.

FIRSTLY OPEN DEMAT ACCOUNT FOR INVESTMENT IN SIP

Passive SIP Investors:

Passive SIP investors take a more hands-off approach to their investments. They believe in a long-term, buy-and-hold strategy and do not frequently alter their SIP contributions. Here’s why some investors prefer a passive approach:

- Diversification: Passive investors often choose index funds or exchange-traded funds (ETFs) that provide instant diversification across various asset classes. They believe in the wisdom of the market.

- Cost Efficiency: Passive investing is typically associated with lower management fees and transaction costs. It’s a cost-effective way to invest, as it requires less frequent buying and selling of assets.

- Reduced Emotional Stress: Passive investors are less affected by short-term market fluctuations and do not need to make constant decisions based on market sentiment. This can reduce the emotional stress associated with active investing.

Which Approach Is Smarter?

The choice between an active or passive SIP investment strategy depends on your financial goals, Who Acts Smarter in SIP Investments risk tolerance, and investment knowledge. Here are some factors to consider when making your decision:

- Time and Effort: Active investing requires time, research, Who Acts Smarter in SIP Investments and continuous monitoring. If you have the time and expertise to actively manage your investments, it could be a smart choice.

- Risk Tolerance: Active investors should have a higher risk tolerance as their strategies involve more market exposure. Passive investors often have a lower risk threshold due to their long-term, diversified holdings.

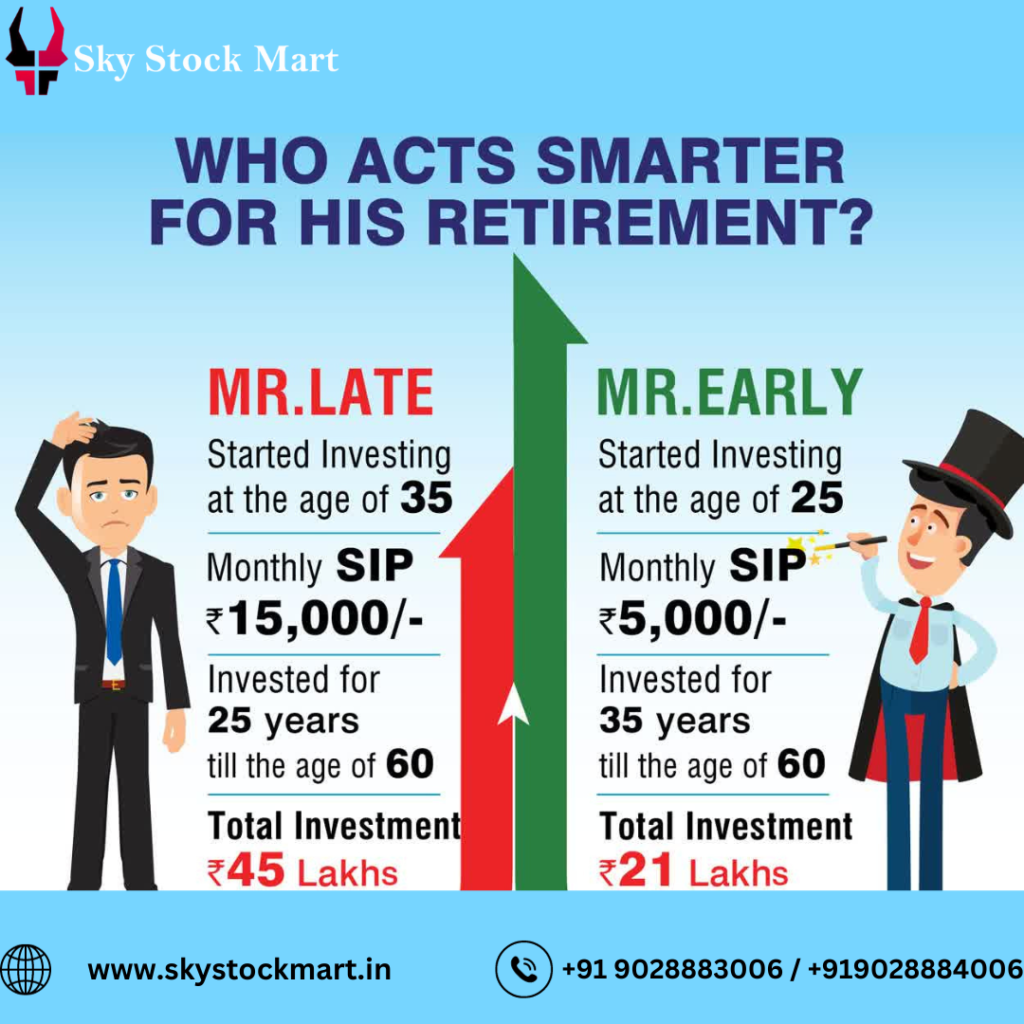

- Long-Term vs. Short-Term Goals: Passive investors typically have long-term financial goals and are comfortable with a “set it and forget it” approach. Active investors might be suitable for short-term goals that require active management.

- Cost Considerations: Passive investing is often more cost-effective due to lower fees and fewer transactions. Who Acts Smarter in SIP Investments Consider your budget and how much you’re willing to spend on management fees.

FIRSTLY OPEN DEMAT ACCOUNT FOR INVESTMENT IN SIP

Conclusion:

In the debate of active vs. passive SIP investing, there is no one-size-fits-all answer. The smarter approach depends on your individual financial situation, goals, and risk tolerance. Some investors might find success with an active approach, while others may prefer the simplicity and cost-effectiveness of passive investing.Who Acts Smarter in SIP Investments The key is to align your SIP investment strategy with your unique financial objectives and continually evaluate your approach to ensure it’s helping you achieve your goals. Ultimately, a smart SIP investor is one who understands their own financial situation and makes decisions accordingly.