Decoding Lots: Understanding the Meaning in the Stock Market

Introduction:

What is the Meaning of Lots in stock market ? In the intricate world of the stock market, investors encounter a myriad of terms and concepts. One such term that holds significant importance is “Lots.” Understanding the meaning of lots is crucial for investors navigating the complexities of stock trading.What is the Meaning of Lots in stock market ? In this blog post, we will unravel the mystery behind lots in the stock market, exploring what they are, how they function, and why they matter.

LEARN MORE AND OPEN FREE DEMAT ACCOUNT

What is the Meaning of Lots in stock market ?

In the stock market, a “lot” refers to a standardized trading unit for buying or selling shares. It represents a specific quantity of shares bundled together, allowing for easier trading and efficient order execution.What is the Meaning of Lots in stock market ? The size of a lot can vary, but it is typically determined by stock exchanges and trading platforms to maintain liquidity and streamline transactions.

Key Aspects of Lots:

Standardization:

Lots standardize the trading process by grouping shares into predefined quantities. This standardization facilitates smooth trading and ensures that transactions can be executed with precision.

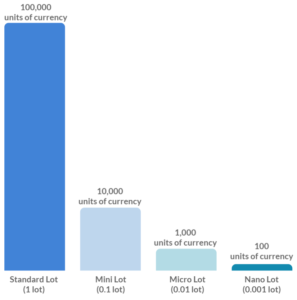

Lot Sizes:

Lot sizes can differ based on the stock’s price, market capitalization, and the exchange’s regulations.What is the Meaning of Lots in stock market ? For example, some stocks may have a lot size of 100 shares, while others might have a lot size of 1,000 shares or more.

Order Execution:

When investors place buy or sell orders, they do so in terms of lots. This means that instead of specifying the number of individual shares, they indicate the number of lots they wish to trade.

Liquidity:

Lots play a crucial role in maintaining liquidity in the market.What is the Meaning of Lots in stock market ? Standardized lot sizes make it easier for buyers and sellers to find each other, enhancing the overall efficiency of the stock market.

Why Lots Matter:

LEARN MORE AND OPEN FREE DEMAT ACCOUNT

Precision in Trading:

Lots provide a level of precision in trading by allowing investors to buy or sell shares in standardized quantities. This simplifies the process of matching buy and sell orders.

Risk Management:

Investors use lot sizes as part of their risk management strategy.What is the Meaning of Lots in stock market ? By trading in standardized lots, investors can better control the amount of capital at risk in each transaction.

Market Liquidity:

Standardized lots contribute to market liquidity by creating a common ground for transactions. This ensures that there is a consistent and standardized approach to trading across different stocks.

Facilitating Institutional Trading:

Institutional investors often deal with large quantities of shares. Lots make it feasible for these investors to execute significant transactions without causing disruptions in the market.

Conclusion:

In the stock market, lots serve as a fundamental building block of trading. They provide order and structure to the buying and selling of shares, ensuring that transactions occur efficiently and with precision. Understanding the meaning and significance of lots is essential for investors seeking to navigate the dynamic and intricate landscape of the stock market.What is the Meaning of Lots in stock market ? Whether you’re a seasoned trader or a newcomer, grasping the concept of lots is a key step towards becoming a more informed and confident investor.