Understanding Currency Market Timing: When and How to Trade

Introduction

What is the currency market timing ?

The foreign exchange (Forex or FX) market is the largest financial market in the world, with a daily trading volume that surpasses $6 trillion. This global marketplace operates 24 hours a day, five days a week, making it unique in the world of finance. Understanding currency market timing is essential for traders and investors seeking to navigate this dynamic and potentially lucrative market. In this blog, we’ll explore the intricacies of Forex market hours and how to make the most of them.

Open free demat account and know all about Stock market

- The 24-Hour Forex Market

Unlike other financial markets, such as stock exchanges that have specific trading hours, the Forex market operates around the clock. This continuous trading is made possible by the fact that Forex is a decentralized market with participants from all over the world, including major financial centers like New York, London, Tokyo, and Sydney.

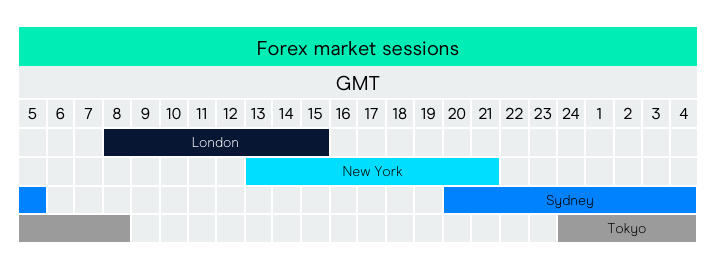

The Forex market can be divided into four major trading sessions, each corresponding to a major financial hub:

a. Sydney Session: Opens at 8:00 AM local time (AEDT) and overlaps with the Tokyo session. b. Tokyo Session: Opens at 8:00 AM local time (JST) and overlaps with the London session. c. London Session: Opens at 8:00 AM local time (GMT) and overlaps with the New York session. What is the currency market timing ? d. New York Session: Opens at 8:00 AM local time (EST).

These sessions have their own unique characteristics, and the most active and liquid trading occurs when multiple sessions overlap.

Open free demat account and know all about Stock market

- Key Trading Hours

To maximize your trading opportunities, you should be aware of the key trading hours within each session. These are typically when the highest trading volumes occur, What is the currency market timing ? resulting in tighter spreads and increased market activity. Here’s a breakdown of these hours by major trading sessions:

a. London Session (8:00 AM to 4:00 PM GMT): What is the currency market timing ? This session is considered the most important, with the highest trading volume. The first few hours of overlap with the Tokyo session often see strong price movements.

b. New York Session (8:00 AM to 4:00 PM EST): As the London and New York sessions overlap, this period experiences high trading activity, with many major currency pairs seeing substantial price swings.

c. Tokyo Session (8:00 AM to 4:00 PM JST): The Tokyo session is known for its relative stability and often sets the tone for the day. What is the currency market timing ? The overlap with the London session is crucial for traders looking for volatility.

d. Sydney Session (8:00 AM to 4:00 PM AEDT): While the Sydney session is the smallest in terms of trading volume, it provides opportunities for traders in the Asia-Pacific region.

Open free demat account and know all about Stock market

- Weekend Gaps

Although the Forex market is open 24 hours, it’s important to note that it closes for the weekend. The market closes on Friday at 5:00 PM EST and reopens on Sunday at 5:00 PM EST. What is the currency market timing ? During this period, known as the weekend gap, What is the currency market timing ? significant price gaps can occur due to economic events and news releases that transpired over the weekend.

- Choosing the Right Time to Trade

The right time to trade in the Forex market depends on your trading style, strategy, and personal schedule. Traders can be categorized into day traders, swing traders, and position traders, each of whom may have different preferences for trading times.

- Day Traders: These traders seek to profit from short-term price movements and often focus on the most active trading hours during session overlaps.

- Swing Traders: Swing traders aim to capture larger price moves over several days or weeks, so they may not be as concerned with intraday timing.

- Position Traders: Position traders take a long-term approach and make fewer trades, focusing on broader economic trends and fundamentals.

Conclusion

Understanding currency market timing is essential for success in the Forex market. What is the currency market timing ? Knowing the key trading hours, session overlaps, and your own trading style is crucial for making informed decisions and maximizing your potential for profit. However, it’s essential to remember that the Forex market is complex, and trading carries inherent risks. It’s wise to educate yourself, practice with a demo account, and, if possible, seek guidance from experienced traders or financial advisors before diving into the world of currency trading.