Demystifying the PE Ratio: A Fundamental Metric in the Stock Market

Introduction:

What is PE Ratio in Stock Market

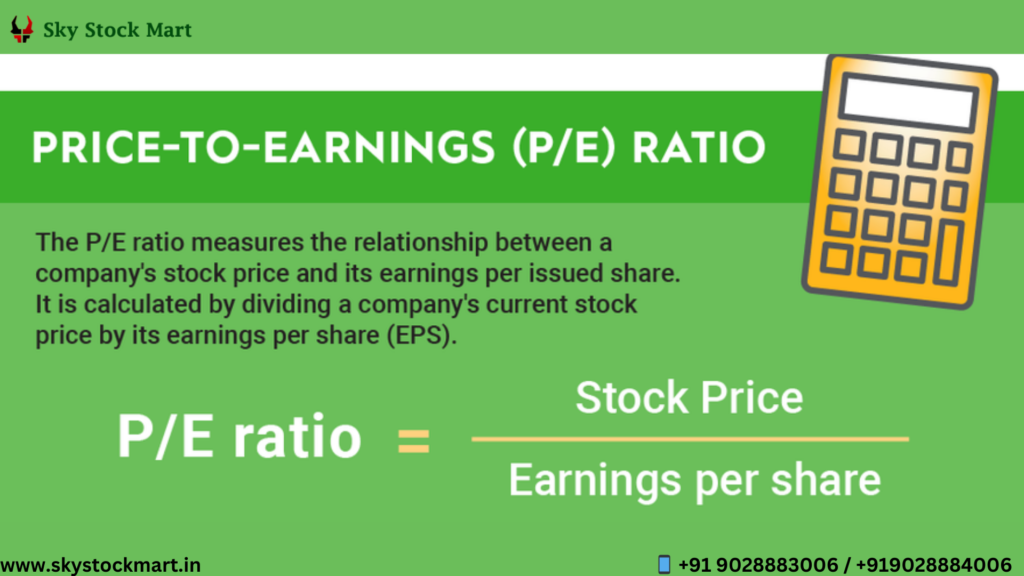

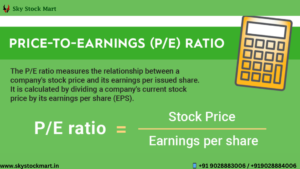

In the intricate world of stock market analysis, investors often turn to a plethora of metrics to evaluate the attractiveness of a particular stock. One such fundamental indicator that plays a crucial role in assessing a company’s valuation is the Price-to-Earnings (PE) ratio. This metric serves as a valuable tool for investors seeking insights into a stock’s potential for growth and its relative value within the market. In this blog post, we will unravel the complexities of the PE ratio, exploring its significance, calculation, and its implications for investors. What is PE Ratio in Stock Market

Understanding the PE Ratio:

The Price-to-Earnings ratio is a straightforward but powerful metric that compares a company’s current stock price to its earnings per share (EPS). In essence, it provides investors with an indication of how much they are willing to pay for each dollar of earnings generated by the company.

Key Components:

- Market Price per Share: This is the current market value of a single share of the company’s stock. It reflects the collective sentiment and expectations of investors regarding the company’s future prospects.

- Earnings per Share (EPS): EPS is a measure of a company’s profitability and is calculated by dividing the company’s total earnings by the number of outstanding shares. It represents the portion of a company’s profit allocated to each outstanding share of common stock.What is PE Ratio in Stock Market

Interpreting the PE Ratio:

- High PE Ratio: A high PE ratio suggests that investors have high expectations for future earnings growth. It may indicate that the stock is potentially overvalued, and investors are willing to pay a premium for anticipated future earnings.

- Low PE Ratio: Conversely, a low PE ratio may suggest that the stock is undervalued, as investors are paying less for each dollar of current earnings. What is PE Ratio in Stock Market This could be an indication that the market has lower expectations for future earnings growth.

- Industry and Sector Comparisons: It’s important to consider the PE ratio within the context of the industry or sector. Some industries naturally have higher average PE ratios due to the nature of their business, while others may have lower averages.

- Historical Comparison: Comparing a company’s current PE ratio to its historical PE ratios can provide insights into whether the stock is trading at a premium or discount relative to its own historical valuation.What is PE Ratio in Stock Market

Conclusion:

The PE ratio serves as a valuable tool for investors navigating the complexities of the stock market. While it is not a standalone indicator for investment decisions, understanding the PE ratio in conjunction with other financial metrics can provide a more comprehensive picture of a company’s valuation. As with any financial metric, What is PE Ratio in Stock Market it’s crucial for investors to consider a holistic approach, taking into account the company’s financial health, growth prospects, and market conditions before making investment decisions.