What is Beta?

Introduction

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

In finance, the beta is a statistic that measures the expected increase or decrease of an individual stock price in proportion to the movements of the stock market as a whole. Beta can be used to indicate the contribution of an individual asset to the market risk of a portfolio when it is added in a small quantity.

Demystifying Beta: Understanding Its Significance in the Stock Market

In the intricate landscape of the stock market, investors employ various metrics to assess the risk and return potential of a stock. One such metric that plays a crucial role in this evaluation is “Beta.” In this blog post, we’ll unravel the mystery surrounding Beta, exploring its definition, calculation, and the valuable insights it provides for investors.

Defining Beta

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

Beta is a statistical measure that gauges the volatility of a stock in relation to the overall market. More specifically, it quantifies how much a stock’s price tends to move concerning a benchmark index, typically the broader market index such as the S&P 500. A Beta value of 1 implies the stock’s price moves in tandem with the market, What is Beta in stock market What is Beta in stock market while a Beta greater than 1 indicates higher volatility, and a Beta less than 1 suggests lower volatility.

What is Beta? Key Components

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

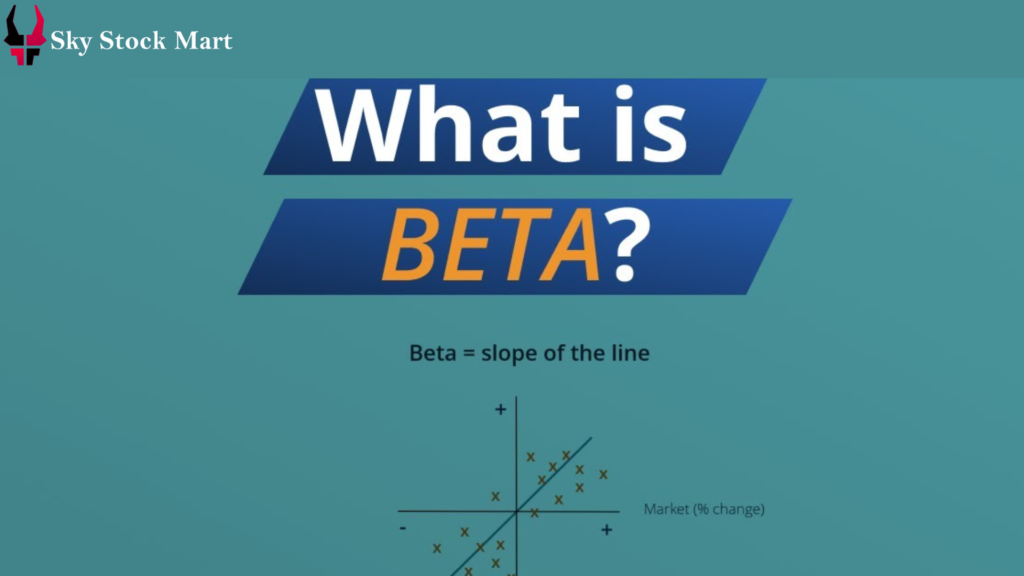

- Calculation of Beta: Beta is calculated using historical price data for both the stock in question and the chosen benchmark index. The formula for Beta is as follows:Beta=Covariance of Stock Returns with Market ReturnsVariance of Market ReturnsBeta=Variance of Market ReturnsCovariance of Stock Returns with Market ReturnsThis formula quantifies the sensitivity of the stock’s returns to market movements.

- Interpreting Beta Values:

- Beta = 1: The stock moves in line with the market.

- Beta > 1: The stock is more volatile than the market.

- Beta < 1: The stock is less volatile than the market.

Understanding these values helps investors assess the risk associated with a particular stock.

- Risk and Return Assessment: Beta serves as a crucial tool for investors to evaluate the risk-return tradeoff of a stock. A higher Beta suggests higher potential returns but also greater risk,, What is Beta in stock market while a lower Beta indicates more stability but potentially lower returns.

- स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

Application in Stock Market Analysis

- Portfolio Construction: Investors often use Beta to construct well-diversified portfolios. By combining stocks with different Beta values, investors can manage overall portfolio risk and potentially enhance returns.

- Market Sentiment Analysis: Changes in a stock’s Beta over time can indicate shifts in market sentiment towards that stock. This information can be valuable for investors adjusting their strategies based on evolving market conditions.

- Risk Management: Beta is a key tool in risk management. , What is Beta in stock market Investors can use it to align their portfolios with their risk tolerance and investment objectives.

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

What Is Beta?

Beta is a measure of a stock’s volatility in relation to the overall market. By definition, the market, such as the S&P 500 Index, has a beta of 1.0, and individual stocks are ranked according to how much they deviate from the market. A stock that swings more than the market over time has a beta above 1.0. If a stock moves less than the market, the stock’s beta is less than 1.0.

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

What is Beta? Understanding Beta in Investing

How should investors assess risk in the stocks that they buy or sell? While the concept of risk is hard to factor in stock analysis and valuation, one of the most popular indicators is a statistical measure called beta.

Beta measures risk in the form of volatility against a benchmark and is based on the principle that higher risk come with higher potential rewards. Analysts use beta when they want to determine a stock’s risk profile. High-beta stocks, which generally means any stock with a beta higher than 1.0, are supposed to be riskier but provide higher return potential; low-beta stocks, those with a beta under 1.0, pose less risk but also usually lower returns.

What is Beta? Conclusion

In conclusion, Beta is a powerful metric in the realm of stock market analysis. By providing insights into a stock’s volatility in relation to the broader market, Beta empowers investors to make informed decisions about risk and return. , What is Beta in stock market Whether you’re a seasoned investor or just stepping into the world of stocks, understanding and incorporating Beta into your investment toolkit can contribute to a more well-rounded and strategic approach to stock market participation.