The bottom of the stock market What is the Bottom Line?

The bottom line in the context of the stock market refers to a company’s net income or profit. the Bottom line in stock market It represents the ultimate measure of a company’s financial performance, summarizing revenues, expenses, taxes, and other financial elements to determine the overall profitability. Investors keen on evaluating the financial health of a company often turn to the bottom line as a key metric.

Understanding Net Income:

Net income is a fundamental component of the bottom line and is calculated by subtracting a company’s total expenses from its total revenue. This figure provides a snapshot of how efficiently a company is operating and generating profits. Investors typically examine net income over different periods to identify trends and assess a company’s ability to sustain profitability.

Earnings Per Share (EPS)

To make the bottom line more relatable for investors, earnings per share (EPS) is often used. EPS is calculated by dividing a company’s net income by its outstanding shares. This metric gives investors insights into how much profit is attributed to each share, aiding in the comparison of companies of different sizes.

The stock market is highly sensitive to a company’s bottom-line performance. the Bottom line in s

Market Reactions to Bottom Line Performance

tock market Positive earnings reports often lead to increased demand for a company’s stock, causing its price to rise. Conversely, disappointing bottom-line results can trigger sell-offs and declines in stock value. Investors closely monitor earnings seasons, during which companies release their financial results, as these periods can significantly impact market sentiment.

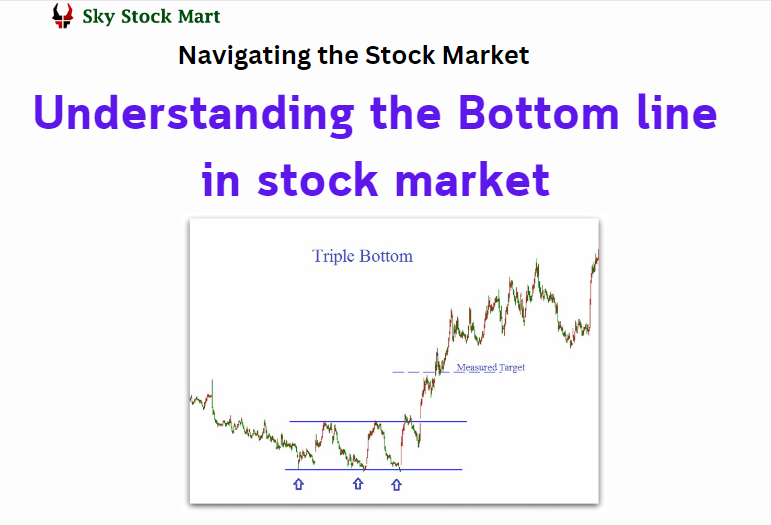

The bottom of the stock market

The bottom line also plays a crucial role in determining a company’s valuation. Investors use various valuation metrics, such as price-to-earnings (P/E) ratio, which compares a company’s stock price to its earnings per share. A lower P/E

Bottom Line and Valuation

ratio may suggest that a stock is undervalued, while a higher P/E ratio may indicate overvaluation. the Bottom line in stock market Understanding a company’s bottom line is essential for making informed investment decisions based on valuation metrics.

Risks and Challenges

While the bottom line is a valuable indicator, investors must consider its limitations. Accounting practices, one-time expenses, and external factors can distort net income figures. Therefore, it’s essential to complement bottom-line analysis with a comprehensive review of a company’s financial statements and economic environment.

The bottom of the stock market Conclusion

In the intricate web of financial analysis, the bottom line stands tall as a critical factor guiding investment decisions. Investors who grasp the nuances of a company’s net income and related metrics are better equipped to navigate the stock market’s complexities.

By understanding the bottom line, investors can make informed choices, capitalize on opportunities, and build a robust investment portfolio in an ever-evolving financial landscape.