Stock Trading Order

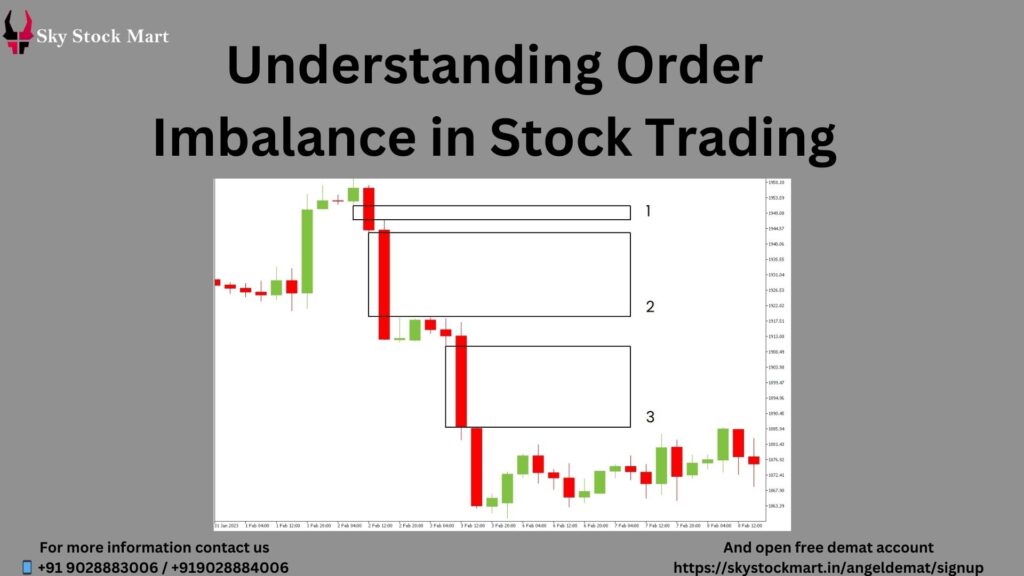

Navigating Market Dynamics: Understanding Order Imbalance in Stock Trading

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

Stock Trading Order Introduction

In the fast-paced and ever-evolving world of stock trading, various factors influence market dynamics, and one of the key elements that traders and investors closely monitor is “order imbalance.”

This phenomenon plays a crucial role in shaping price movements and can offer valuable insights into market sentiment. In this blog post, we’ll delve into the intricacies of order imbalance, exploring its definition, causes, and the impact it can have on financial markets.Demat account

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

Defining Order Imbalance

Order imbalance occurs when there is a significant disparity between the buy and sell orders for a particular stock. In other words, it represents an uneven distribution of market orders, order imbalance. Order Imbalance creating an imbalance in supply and demand.

This imbalance can be observed at different levels, Demat account including individual stocks, specific exchanges, or even the broader market.

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

Causes of Order Imbalance

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

- Market News and Events: Significant news, earnings reports, or unexpected events related to a company can trigger a surge in buy or sell orders, leading to order imbalances. Traders often react swiftly to new information, causing a temporary imbalance until the market stabilizes.

- Market-Maker Activity: Market makers,order imbalance. who facilitate trading by buying and selling securities, can also contribute to order imbalances. Their actions to manage inventory or respond to client orders may result in a temporary imbalance.

- Algorithmic Trading: The prevalence of algorithmic trading has increased in recent years. Algorithms execute trades based on predefined criteria, and when certain conditions are met, they can generate a large number of buy or sell orders, contributing to order imbalances.Demat account

- Market Sentiment: Investor sentiment plays a significant role in order imbalances. Positive or negative sentiment can drive a wave of buying or selling activity, creating an imbalance until the market adjusts to the new information.

-

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

Impact of Order Imbalance

- Price Volatility: Order imbalance often leads to increased price volatility as the market seeks to find a new equilibrium. Rapid price movements can present both opportunities and risks for traders.

- Liquidity Challenges: During periods of order imbalance, liquidity may dry up, making it challenging to execute trades at desired prices. This lack of liquidity can exacerbate price movements.order imbalance.

- Market Corrections: Order imbalances can trigger market corrections, prompting traders to reassess their positions and adjust to the new information. This, in turn, may lead to broader market movements.

- Opportunities for Traders: Astute traders may leverage order imbalance information to identify potential trading opportunities.order imbalance. Recognizing and interpreting order imbalances can be a valuable skill for those looking to capitalize on short-term market movements.

Stock Trading Order Conclusion

स्टॉक मार्केट ट्रेडिंग के लिए निःशुल्क डीमैट खाता खोलें

Order imbalance is a dynamic aspect of stock trading that reflects the ebb and flow of market forces. Understanding the causes and implications of order imbalance empowers traders and investors to navigate the market with greater insight.

As the financial landscape continues to evolve, staying attuned to order imbalances can be a key element of a well-informed and adaptive trading strategy.