What is OTC Stocks

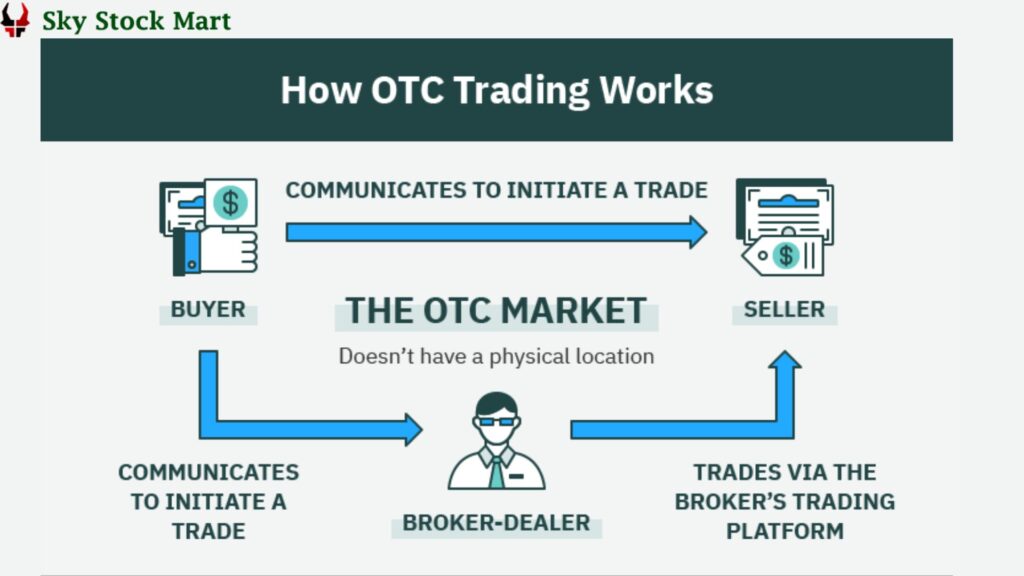

OTC stocks, or Over-the-Counter stocks, refer to stocks that are traded directly between two parties without being listed on a formal stock exchange, such as the New York Stock Exchange (NYSE) or NASDAQ. What is OTC Stocks Instead of being traded on centralized exchanges, OTC stocks are bought and sold through a decentralized network of broker-dealers known as the Over-the-Counter Market.Demat account

Key points about OTC stocks:

- Not Listed on Major Exchanges: OTC stocks are not listed on major stock exchanges, which means they don’t have to comply with the same regulatory requirements and reporting standards as stocks listed on exchanges like NYSE or NASDAQ.

- Broker-Dealer Network: Trading OTC stocks occurs through a network of broker-dealers who facilitate transactions directly between buyers and sellers. The OTC market is decentralized and less formalized compared to traditional exchanges.

- Different Tiers: The OTC market has different tiers, with companies categorized based on factors such as financial disclosure, size, and trading volume. What is OTC Stocks The two primary tiers are OTCQX and OTCQB, with OTCQX representing higher-quality companies with more stringent listing requirements.Demat account

- Greater Risk and Volatility: OTC stocks often carry higher risks and exhibit greater price volatility compared to stocks listed on major exchanges. Investors may encounter lower liquidity, What is OTC Stocks wider bid-ask spreads, and less information available about OTC-listed companies.

- Diverse Range of Companies: The OTC market is home to a diverse range of companies, including smaller companies, penny stocks, and international firms. Investors interested in OTC stocks should conduct thorough research due to the varied nature of companies in this market.

- Penny Stocks: Many OTC stocks are often referred to as penny stocks, What is OTC Stocks which typically trade at a low price per share. These stocks can experience rapid price movements, but they are also associated with higher levels of risk.

- Limited Regulatory Oversight: OTC stocks have less regulatory oversight compared to stocks listed on major exchanges. Investors should exercise caution and conduct due diligence when considering investments in OTC stocks.

It’s important for investors to carefully assess the risks and benefits associated with OTC stocks and consider their risk tolerance and investment objectives before engaging in trading within the OTC market. Due diligence, research, and understanding the unique characteristics of OTC stocks are crucial for making informed investment decisions. What is OTC Stocks