“Demystifying Earnings Per Share (EPS): A Comprehensive Guide on How to Calculate and Understand its Significance in the World of Shares”

Introduction:

How to Calculate EPS in Share

Earnings Per Share (EPS) is a fundamental financial metric that holds immense importance for both investors and companies. Understanding how to calculate EPS is crucial for assessing a company’s profitability and making informed investment decisions. In this blog, we will break down the concept of EPS, Open free demat account provide a step-by-step guide on how to calculate it, and discuss why it matters in the dynamic world of shares.

What is Earnings Per Share (EPS)?

EPS is a financial metric that represents the portion of a company’s profit attributable to each outstanding share of common stock. It serves as a key indicator of a company’s profitability on a per-share basis,How to Calculate EPS in Share allowing investors to gauge the company’s performance and compare it with other companies in the same industry.Open free demat account

How to Calculate EPS:

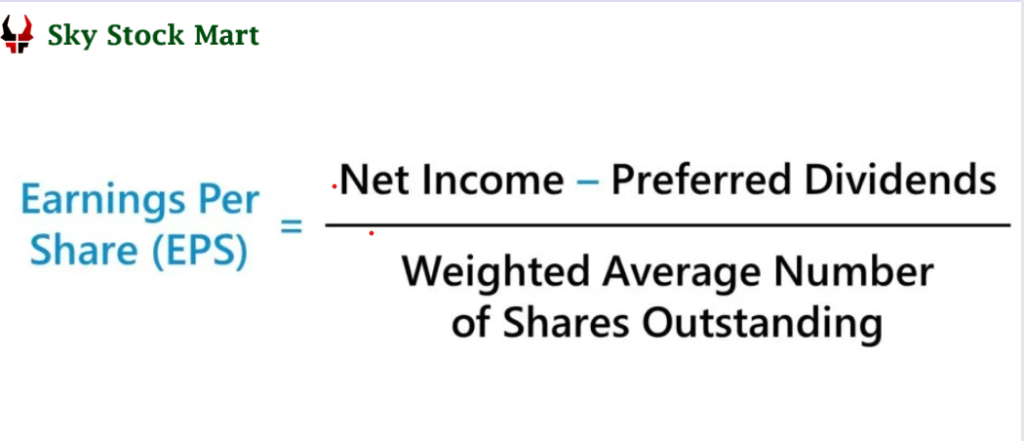

Calculating EPS involves a straightforward formula:

EPS=Net Income−Dividends on Preferred StockWeighted Average Number of Outstanding SharesEPS=Weighted Average Number of Outstanding SharesNet Income−Dividends on Preferred Stock

Let’s break down the components of this formula:

- Net Income:

- Obtain the net income from the company’s income statement. This figure represents the total profit after deducting all expenses, taxes, and interest.

- Dividends on Preferred Stock:

- If the company has preferred stock, subtract the dividends paid to preferred shareholders. How to Calculate EPS in Share This is necessary because preferred stockholders have a claim on a portion of the company’s earnings before common shareholders.

- Weighted Average Number of Outstanding Shares:

- Determine the average number of outstanding shares during the specified time period.How to Calculate EPS in Share This helps account for any fluctuations in the number of shares outstanding over the reporting period.

- Plug into the Formula:

- Substitute the values into the EPS formula to calculate the earnings per share.

Understanding the Significance of EPS:

- Profitability Assessment:

- EPS is a key metric for evaluating a company’s profitability. A higher EPS generally indicates better profitability on a per-share basis.

- Investment Decision-Making:

- Investors often use EPS to make informed investment decisions. How to Calculate EPS in Share Comparing the EPS of different companies within the same industry can help investors identify financially sound investment opportunities.

- Share Price Influence:

- EPS can influence a company’s stock price. How to Calculate EPS in Share Positive earnings growth and higher EPS may lead to an increase in the stock’s market value.

- Indicator of Financial Health:

- Consistent or increasing EPS over time is often considered a positive sign of a company’s financial health and stability.

Conclusion:

In the world of shares, understanding how to calculate EPS is a valuable skill for investors and financial analysts alike. By examining a company’s earnings on a per-share basis, How to Calculate EPS in Share investors can gain insights into its profitability and make more informed decisions. As you delve into the realm of investing, keep in mind that EPS is just one of many factors to consider, but its significance cannot be overstated in the evaluation of a company’s financial performance.Open free demat account